Michigan Homestead Property Tax Credit for Senior Citizens and other Eligible Households

Ida Homestead Property Tax Credit Model Online Calculator

Michigan Homestead Property Tax Credit

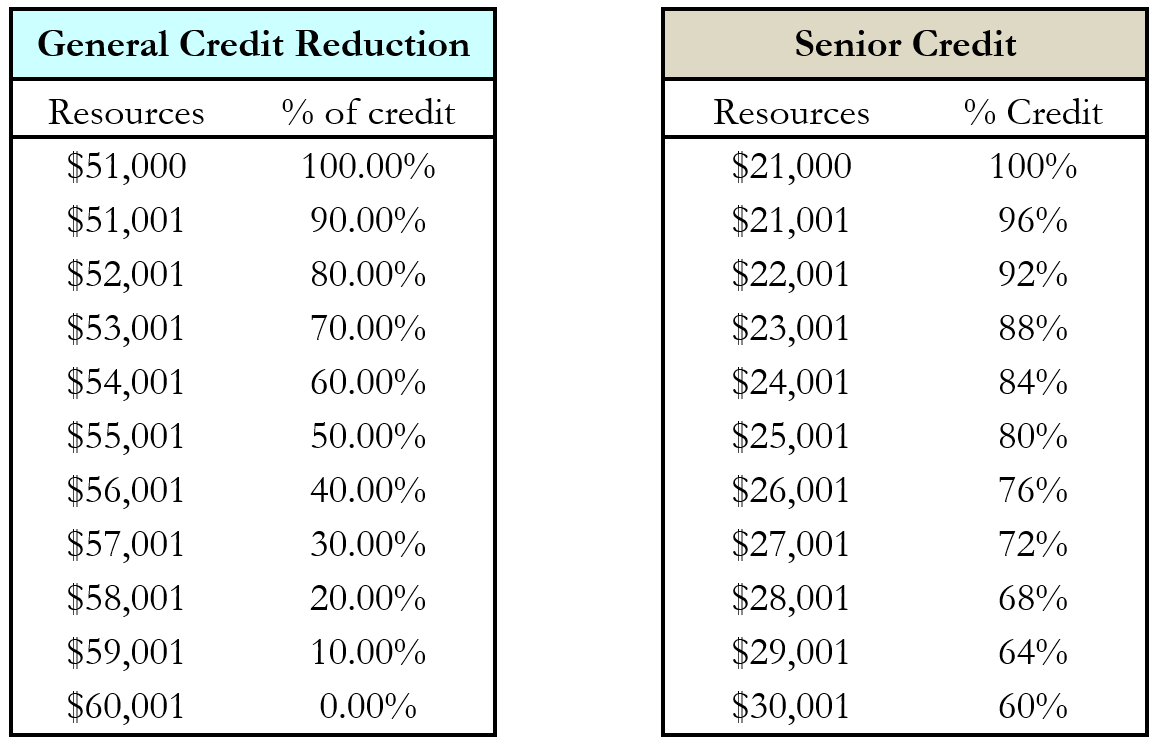

Households that pay homestead property taxes greater than 3.2% of their annual income may be eligible for Michigan’s Homestead Property Tax Credit. Eligible households may deduct up to 60% (up to 100% for senior citizens, please see the senior credit table below) of the millage increase cost up to a $1,500 Homestead Tax Credit limit. The eligibility for the credit begins to decrease after household income exceeds $51,001 and ends completely after the household income exceeds $60,001. Please see below the general reduction table and senior credit table below: